Option Chains

Option Chain windows, in Medved Trader, will allow you to explore the universe of options for a particular symbol using various filters and strategies.

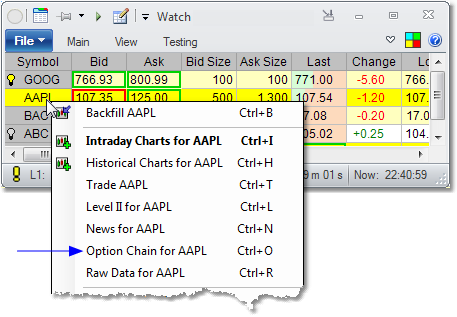

Opening an Option Chain Window |

In order to open an Option Chain window for a particular symbol, right-click on the symbol in a portfolio window, chart window, news window, or any other place in MT that is symbol-specific and pick the Option Chain for... menu option from the context pop-up menu.

In order to access Option Chains information, at least one source has to be configured that delivers Option Chains information, and selected as Default in the Settings - Data sources - Option chains.

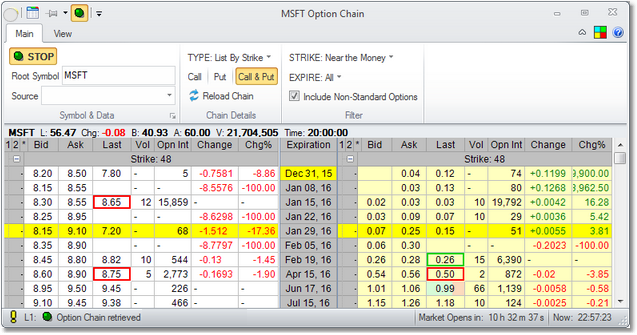

Option Window Contents |

The Option Chain window itself shows, for the symbol, all the existing options for all strikes, types, and expiration dates, and allows the user to group or filter them using various criteria.

The Root Symbol can be switched in the ribbon menu. Just like with a Portfolio window, there is a Source selection, for the data source supplying all the Option Chain information, and the Stop/Start button to regulate the feed.

If the feed is started, the quote information for all the options that are visible in the window will be supplied from the data source and displayed in the tables.

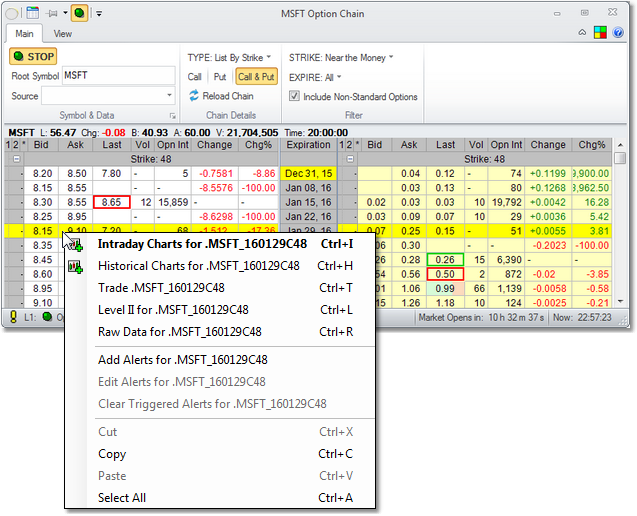

Selecting an Option from the Table |

Regardless of the type of the chain displayed, at some point you will want to select one of the options displayed in order to, for example, chart it, include it in the Portfolio or place it on the Trade Ticket. To do that, you can right-click on the option in the table and select the appropriate option:

Or grab the option from the table and drag/drop it, just like you can do with portfolios and other windows in Medved Trader.

Types of Option Chain (Strategies) |

The options for the Root Symbol selected can be displayed and grouped in various ways:

▪List by Calendar |

Lists all the options ordered by their Expiration Dates (and sorted by Strike within each Expiration Date) |

▪List by Strike |

Lists all the options ordered by their Strikes (and sorted by Expiration Date within each Strike) |

▪Vertical Spreads |

This is an options strategy involving buying and selling of options of the same underlying security, same expiration date, but at different strike prices. The table shows, for each expiration date, all the different strike combinations for this strategy, and the calculated Bids and Asks for executing the Vertical Spread at the particular strike combination. |

▪Calendar Spreads |

This is an options strategy involving buying and selling of options of the same underlying security, same strike price, but different expiration dates. The table shows, for each expiration date pair, all the different strikes for this strategy, and the calculated Bids and Asks for executing the Calendar Spread at the particular strike and expiration date pair. |

▪Straddles |

This is an options strategy where you hold a position in both a call and a put with the same strike and expiration date. The table shows, for each expiration date, the call-put pairs for each strike price and the calculated Bids and Asks for executing the Straddle at the particular expiration date and strike price. |

▪Strangles |

This is an options strategy where you hold a position in both a call and a put with the same expiration date but different strikes. The table shows, for each expiration date, the call-put pairs for each strike price pair and the calculated Bids and Asks for executing the Strangle at the particular expiration date and strike price combination. |

▪Buy/Write |

This is an options strategy where you write call options on an underlying position in hopes of profiting from option premiums. The table shows, for each expiration date, the strikes, option values and the corresponding calculated Close and Open prices for the strategy. |

Filters |

Depending on the Option Chain Type, the resulting table can be filtered using various criteria - if appropriate, you can choose to show only Calls or Puts, limit the strikes to a particular strike or a range of strikes, or limit expiration dates to one date or a range.